Revenue Trends

- State funding has not kept pace with rising costs, unfunded mandates, and growing expectations.

- All school districts rely on school levies to make up for inadequate state funding.

- Over 73% of districts have voter-approved operating levies.

- The disparity in operating levies can range from $0 to over $2,929 per pupil, leaving many students without the educational opportunities they need and deserve.

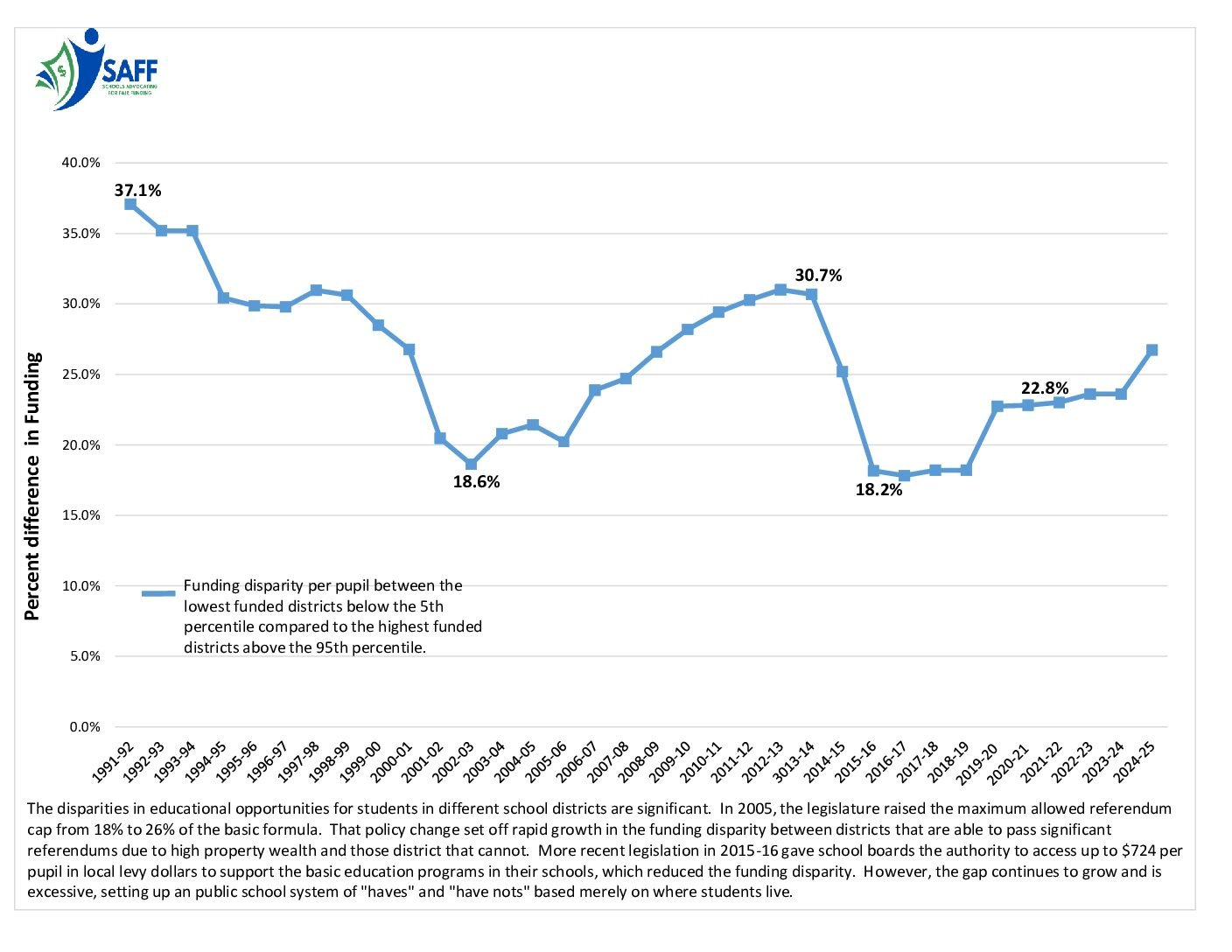

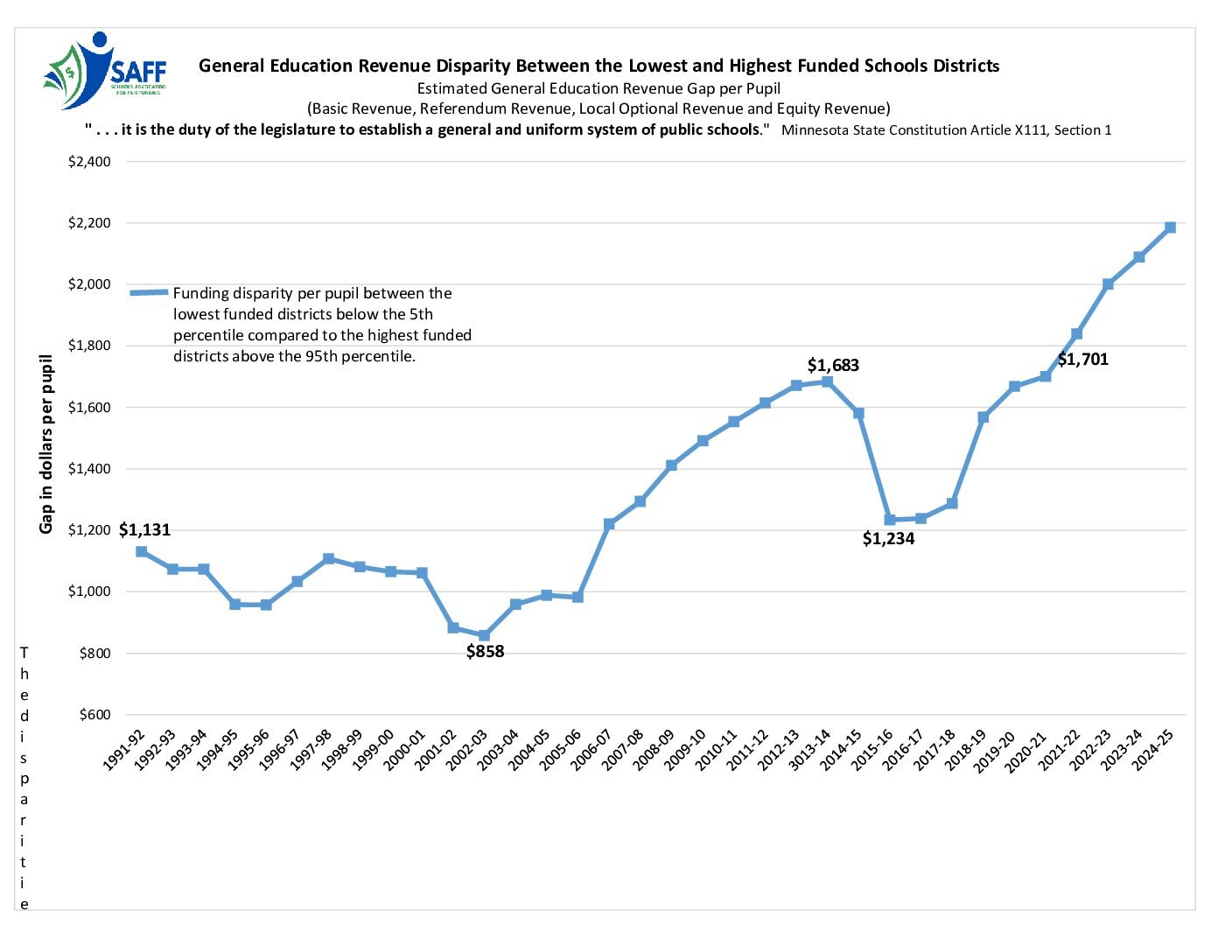

Revenue Disparity Between the Lowest and Highest Funded Schools Districts

The gap in funding between school districts is growing, and most of the growth is due to the disparities in operating levies ranging from $0 to $2,929 per pupil, FY2025

Significant Disparities in District’s Current School Levies

See each district’s operating levies (the school board-approved local optional revenue levy and any voter-approved referendum for all Minnesota school districts. The taxpayer cost for the operating levies is also included.

Revenue Rankings by District

Revenue per school district ranges from $26,676 to $11,038/General Education funding range is $18,336 to $8,927 per pupil. Two factors account for most of the disparity – state aid for school districts with challenging demographics and the inequality in local school levy revenue.

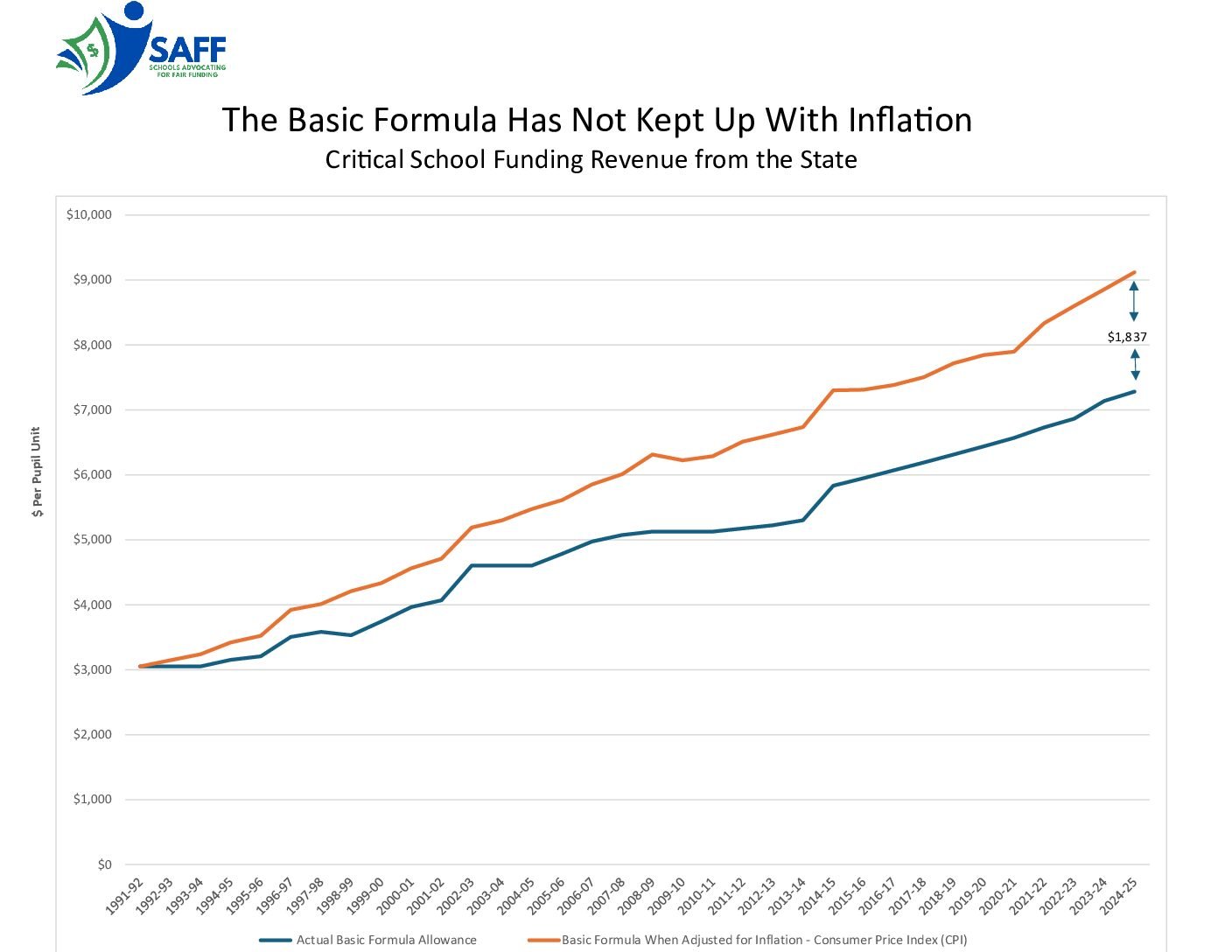

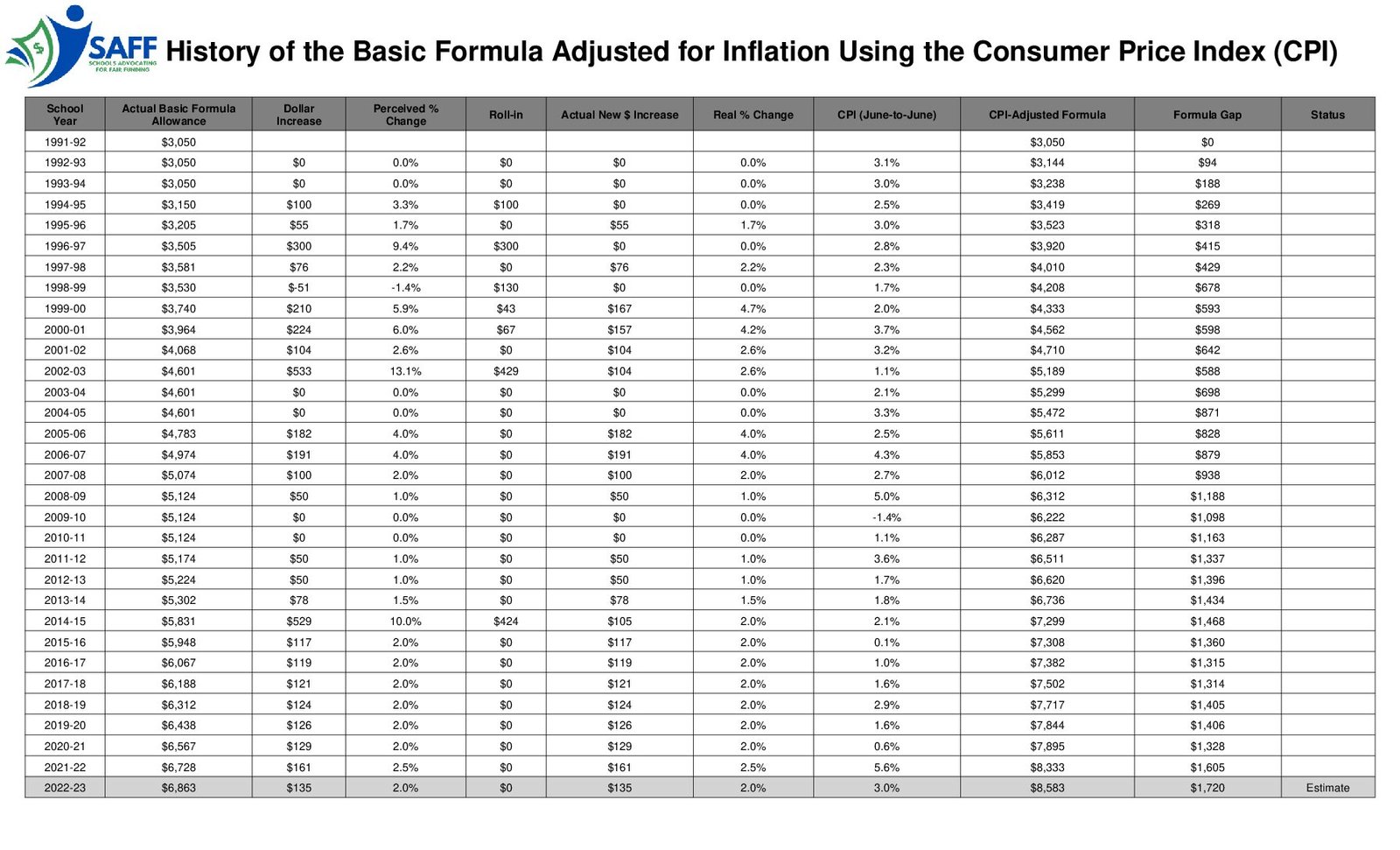

The Basic Funding Formula Has Not Kept Pace with Inflation

Despite steady increases in the basic formula allowance over the years, the revenue has consistently fallen behind inflation because annual adjustments have not been tied to the actual cost of living. Instead, increases have been made sporadically through legislative action, often driven by budget constraints and competing state priorities rather than a formula that keeps pace with inflation. As the history shows, when the formula is adjusted for the Consumer Price Index, the “real” buying power of the allowance has steadily eroded. The result is that in 2025–26, districts will receive $7,481 per pupil when the inflation-adjusted amount should be $9,342 — a gap of $1,861 per student. This persistent gap illustrates how the state’s funding system has shifted more of the burden onto local property taxpayers and made it harder for schools to maintain the same level of services and opportunities that were possible in the early 1990s.

Where Do You Live?

Under current Minnesota law, districts may levy up to a legal referendum cap (estimated at $2,211 per pupil for FY 2025) and may also use up to $724 per pupil in board-approved local optional revenue. Because districts differ in how fully they use referendum authority, and in their property tax base and demographics, the effective disparity between districts can approach $2,929 per pupil in practice.

Minnesota’s National Ranking in School Funding

Residents living in the states at the top of the chart pay more of their income to support their public schools than those living in states at the bottom of the chart.

Unfunded mandates stretch school districts thin.

The financial challenges of unfunded mandates

School districts want to meet the needs of all their students. When mandated services are underfunded, districts rely on the basic formula and school levies to make up for inadequate state funding.

- The Unfunded Cost of Special Education Services by District. The estimates are the most recent data for SY25 as of 10-1-25 (TOTAL SP ED AID) includes the state cross-subsidy reduction aid under M.S. 125A.76, subd 2e

- The Unfunded Cost for English Learning Services by District. The English Learner data are from the general education model as of the February 2025 forecast. The FY26 LEP expenditures are estimates.